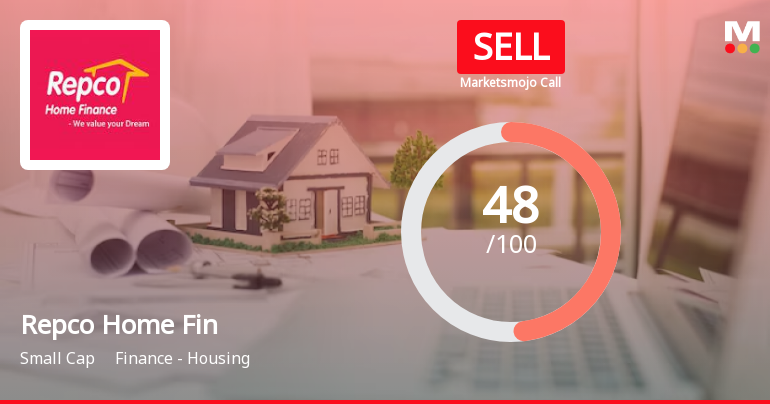

MarketsMOJO Downgrades Repco Home Finance to ‘Sell’ Due to Poor Growth and Bearish Trend

Repco Home Finance, a smallcap company in the finance-housing industry, has recently been downgraded to a ‘Sell’ by MarketsMOJO on 2024-11-12. This decision was based on several factors, including poor long-term growth, a mildly bearish technical trend, and underperformance in the market.

According to MarketsMOJO, Repco Home Finance has shown a slow growth rate in terms of net sales and operating profit, with an annual growth rate of 4.97% and 4.89%, respectively. The stock is also currently in a mildly bearish range, with a technical trend that has deteriorated since 12-Nov-24 and has generated a -4.36% return since then. Multiple factors, such as MACD, Bollinger Band, and KST, have been identified as bearish for the stock.

In the past year, Repco Home Finance has generated a return of 4.65%, significantly lower than the market (BSE 500) return of 27.99%. However, the company has shown strong long-term fundamental strength, with an average return on equity (ROE) of 12.76%. It has also declared positive results for the last 7 consecutive quarters, with a growth rate of 26.10% in PAT (HY) and a low debt-equity ratio of 3.58 times. Additionally, its net sales for the quarter were the highest at Rs 407.83 crore.

With an ROE of 13.9, Repco Home Finance currently has an attractive valuation with a 1 price to book value. The stock is trading at a fair value compared to its average historical valuations. Furthermore, while the stock has generated a return of 4.65% in the past year, its profits have risen by 30.4%, resulting in a PEG ratio of 0.2.

It is also worth noting that Repco Home Finance has a high institutional holding of 32.81%. This indicates that these investors have better capability and resources to analyze the fundamentals of companies, making their decision to sell the stock even more significant.

In conclusion, based on the current market trends and performance, MarketsMOJO has downgraded Repco Home Finance to a ‘Sell’. However, the company has shown strong long-term fundamental strength and attractive valuations, making it a stock to keep an eye on for potential future growth.

link

:max_bytes(150000):strip_icc()/2680401-iDEAH-D3-6-2000-746d5ce258d44245b152d00eb5ad54ca.jpg)